| HOME | SEARCH | ABOUT US | CONTACT US | HELP | ||

| |

| Rule: 42.4.2708 | Prev Up Next | |

| Rule Title: DETERMINING PRESENT VALUE FOR THE ENDOWMENT CREDIT | ||

|

Add to Favorites |

||

| Department: | REVENUE | |

| Chapter: | TAX CREDITS | |

| Subchapter: | Individual and Corporation - Qualified Endowment | |

| Latest version of the adopted rule presented in Administrative Rules of Montana (ARM): | ||

| Printer Friendly Version |

|

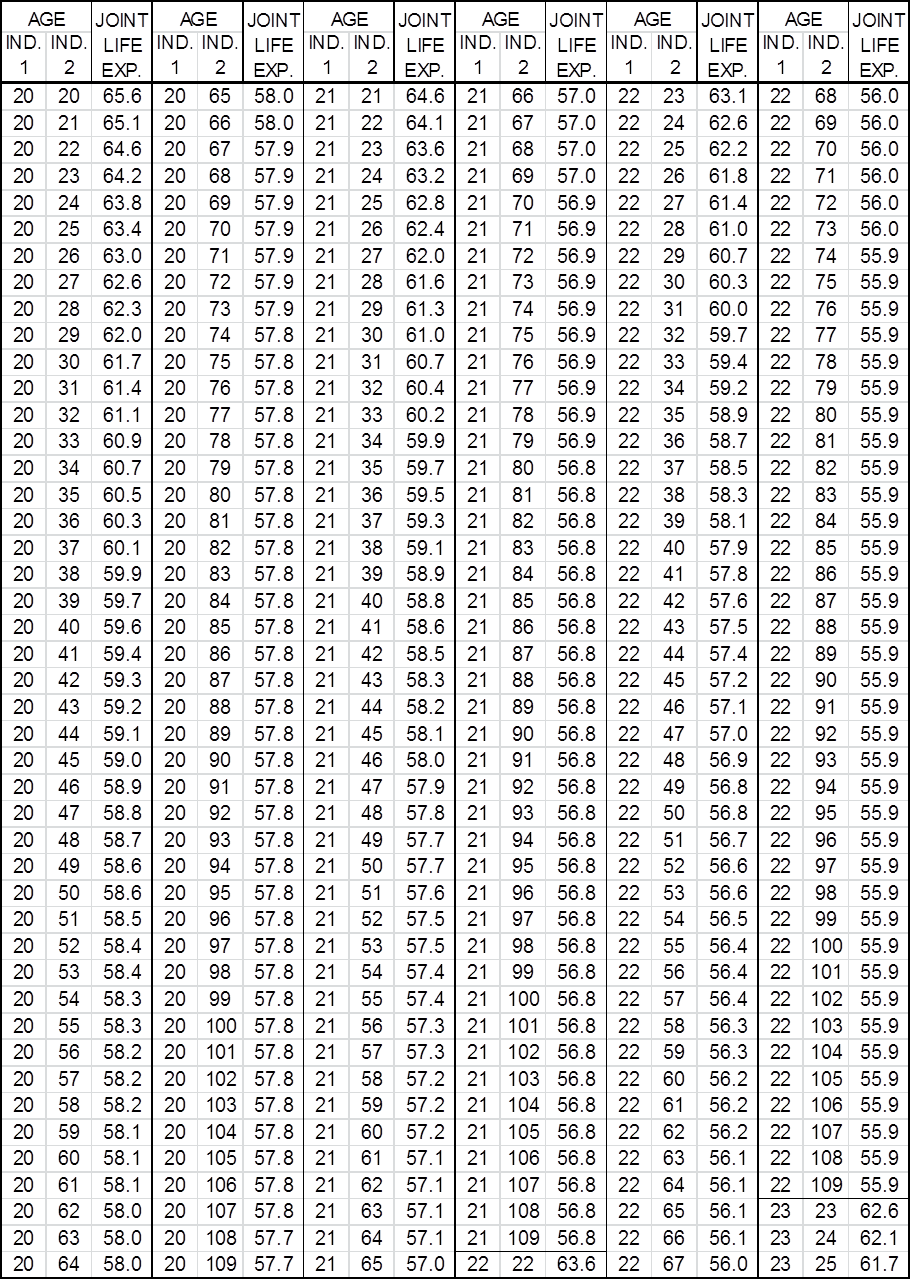

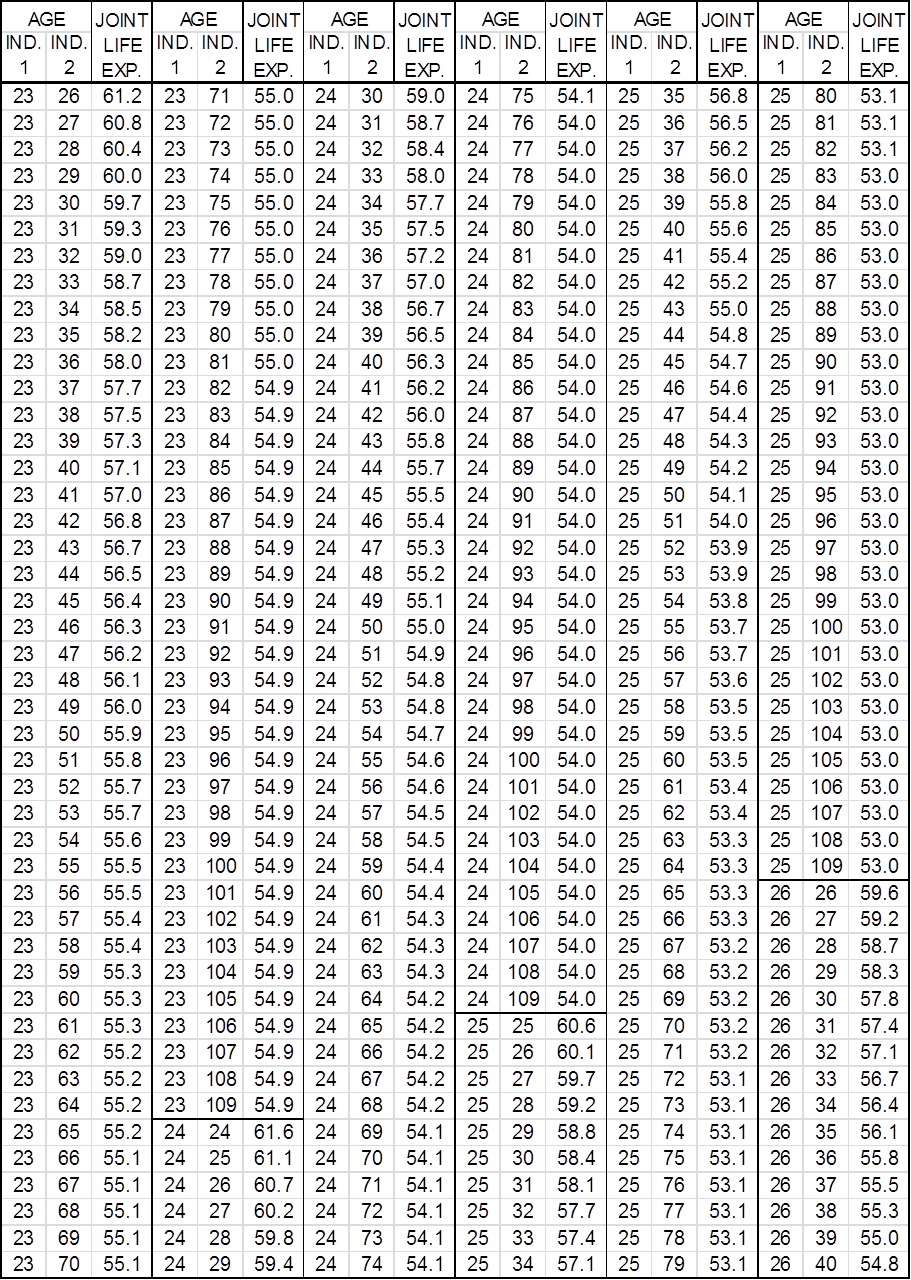

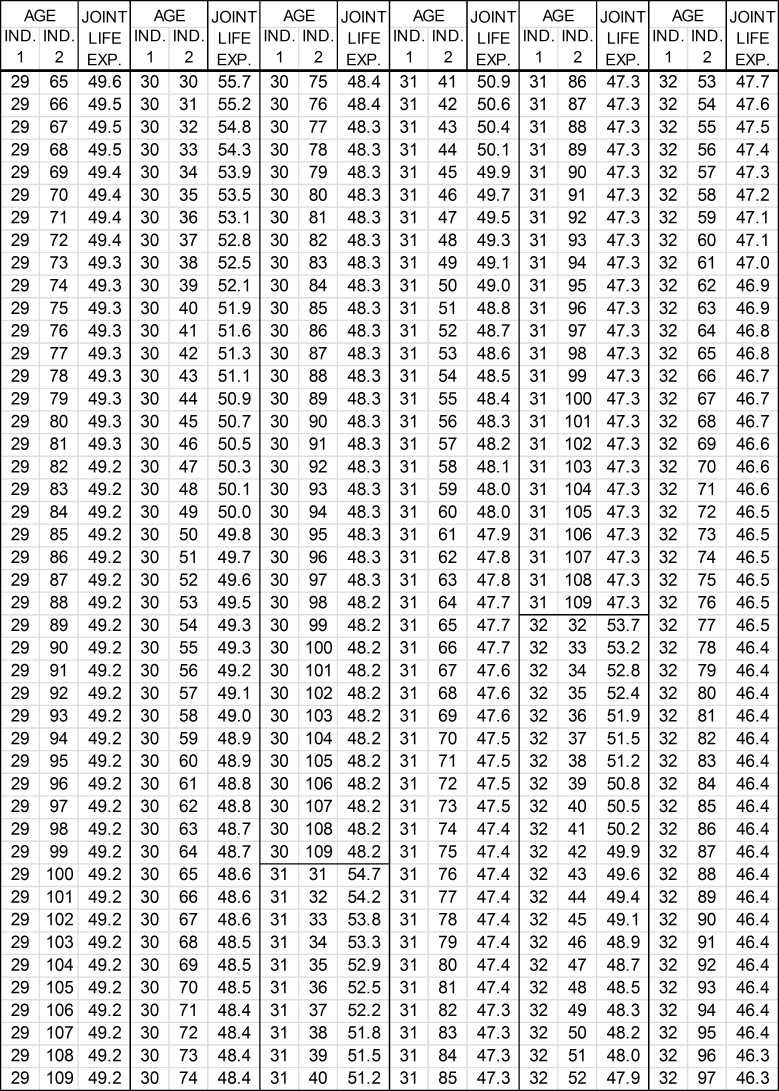

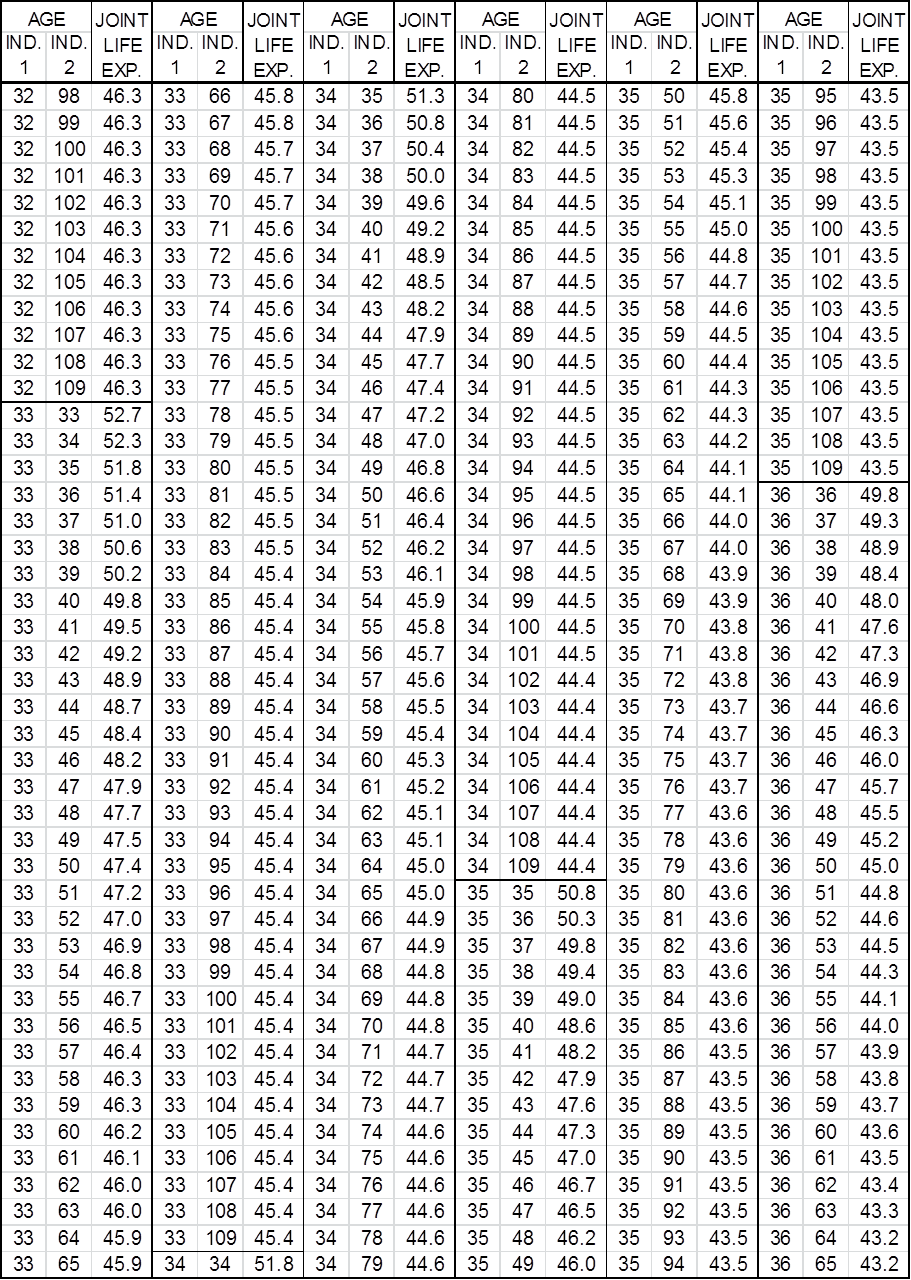

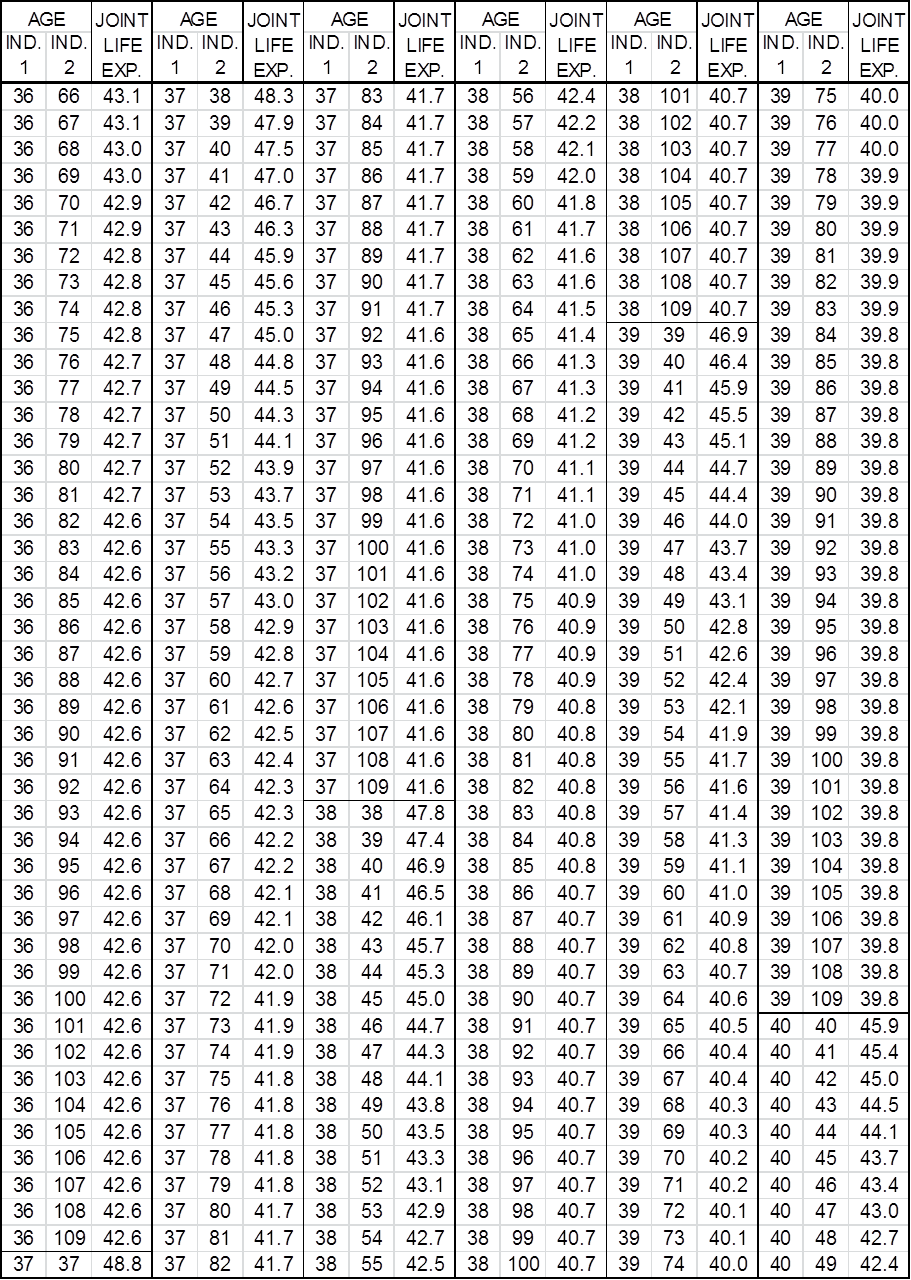

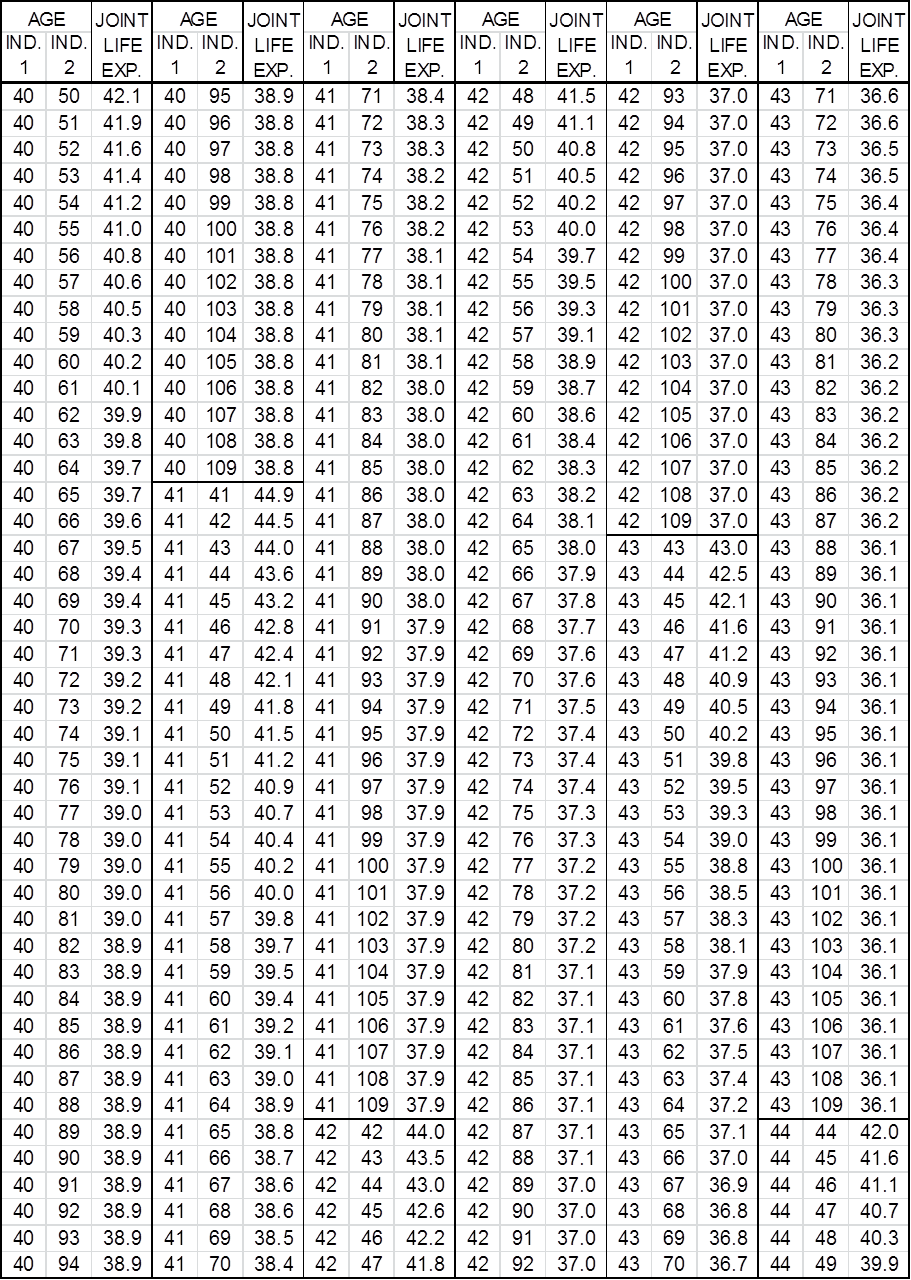

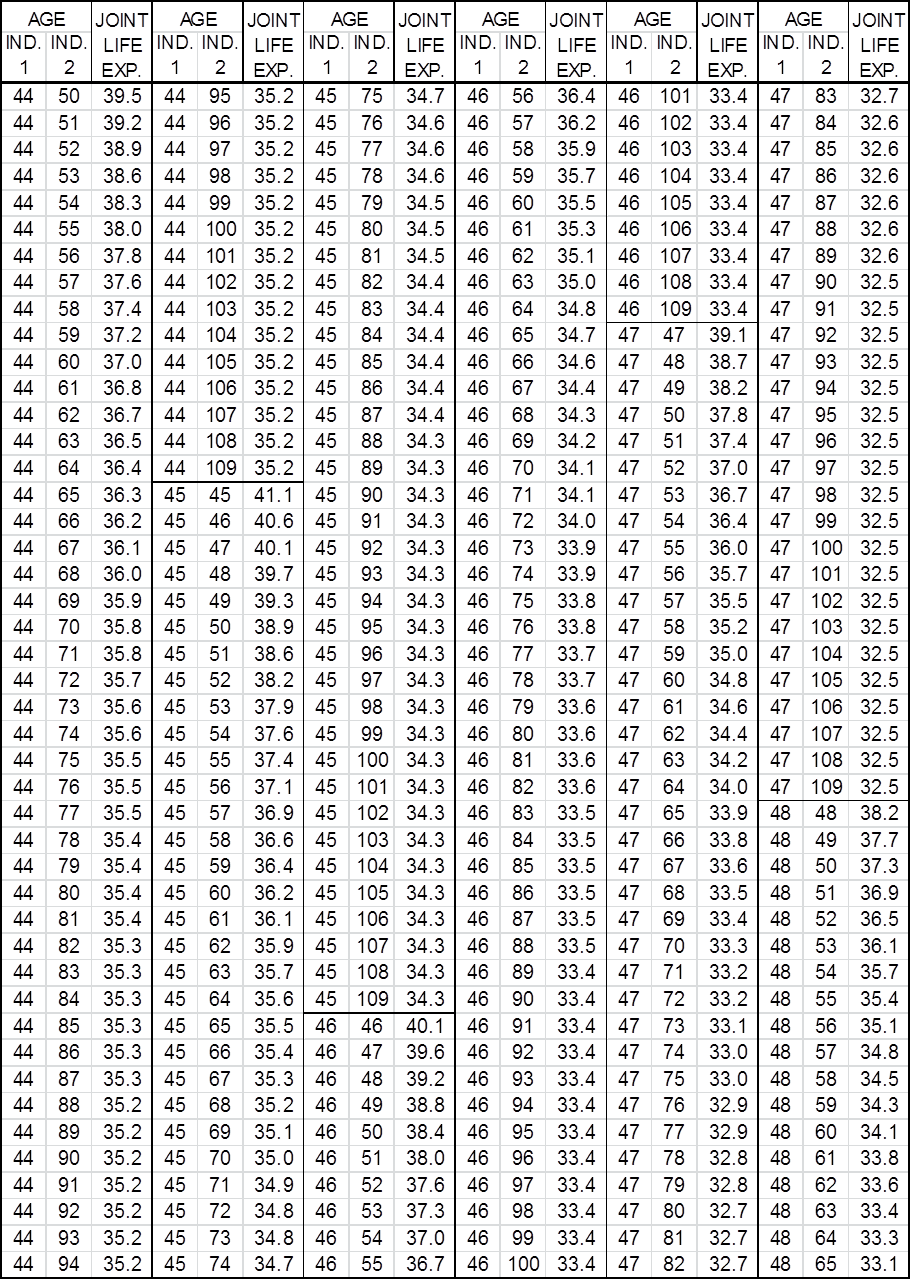

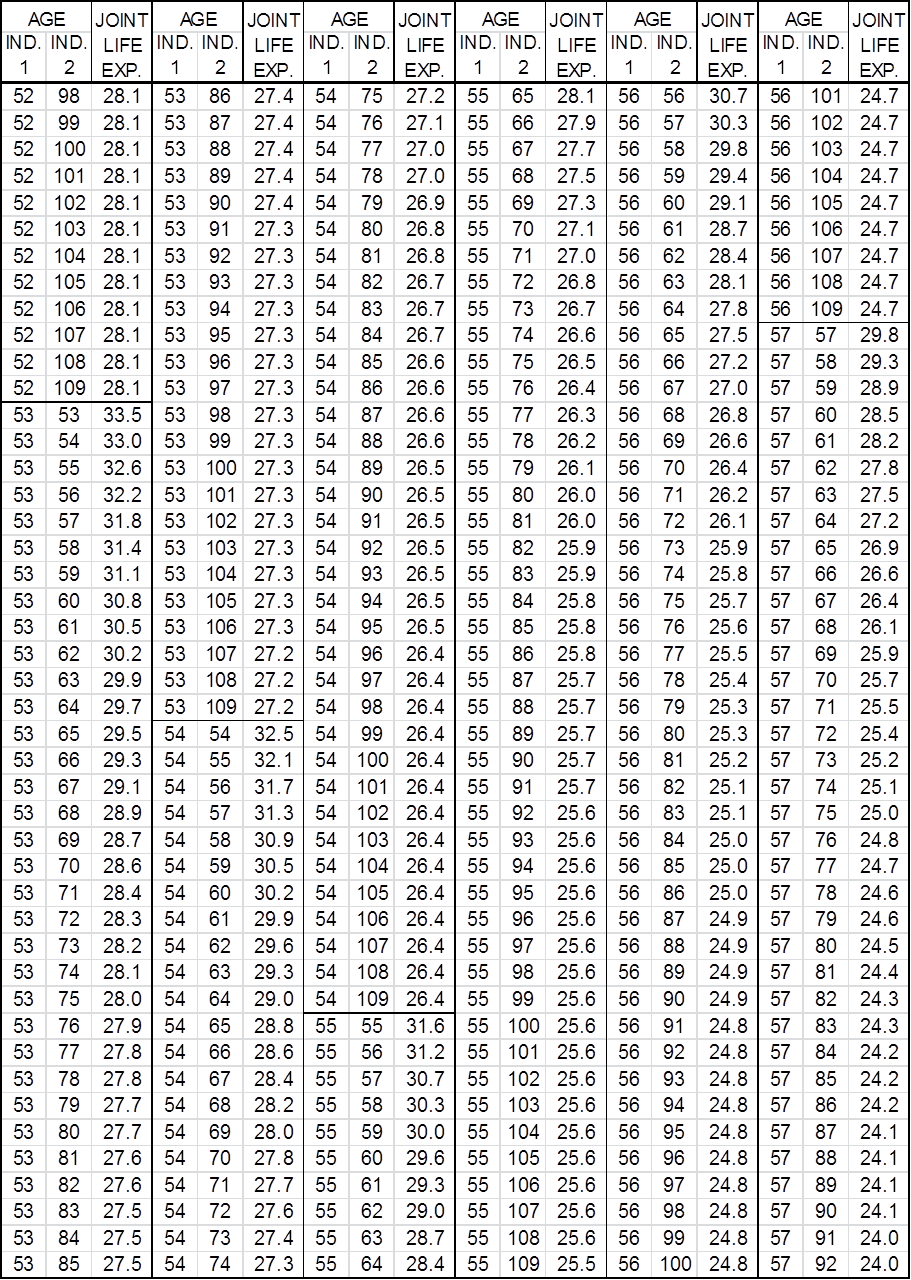

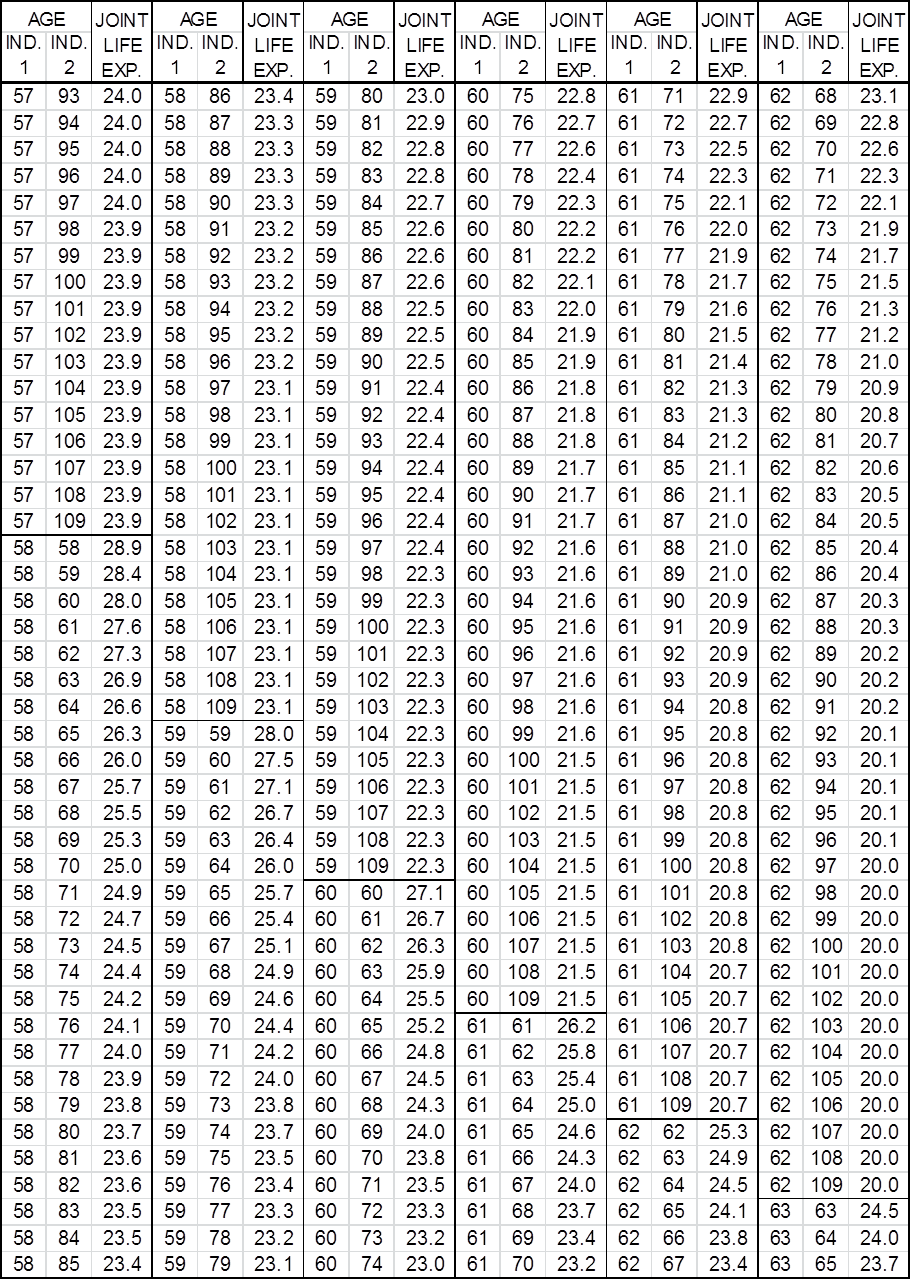

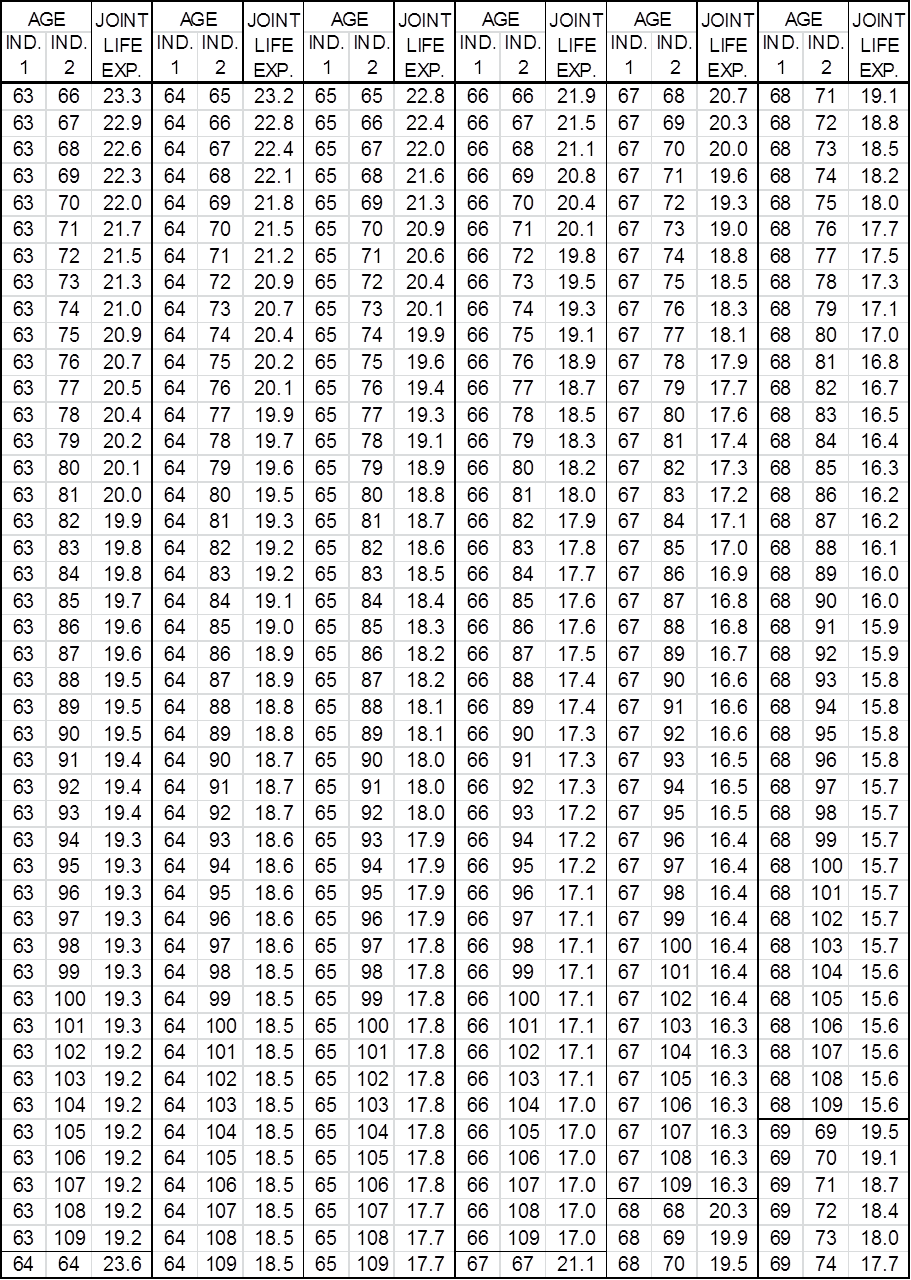

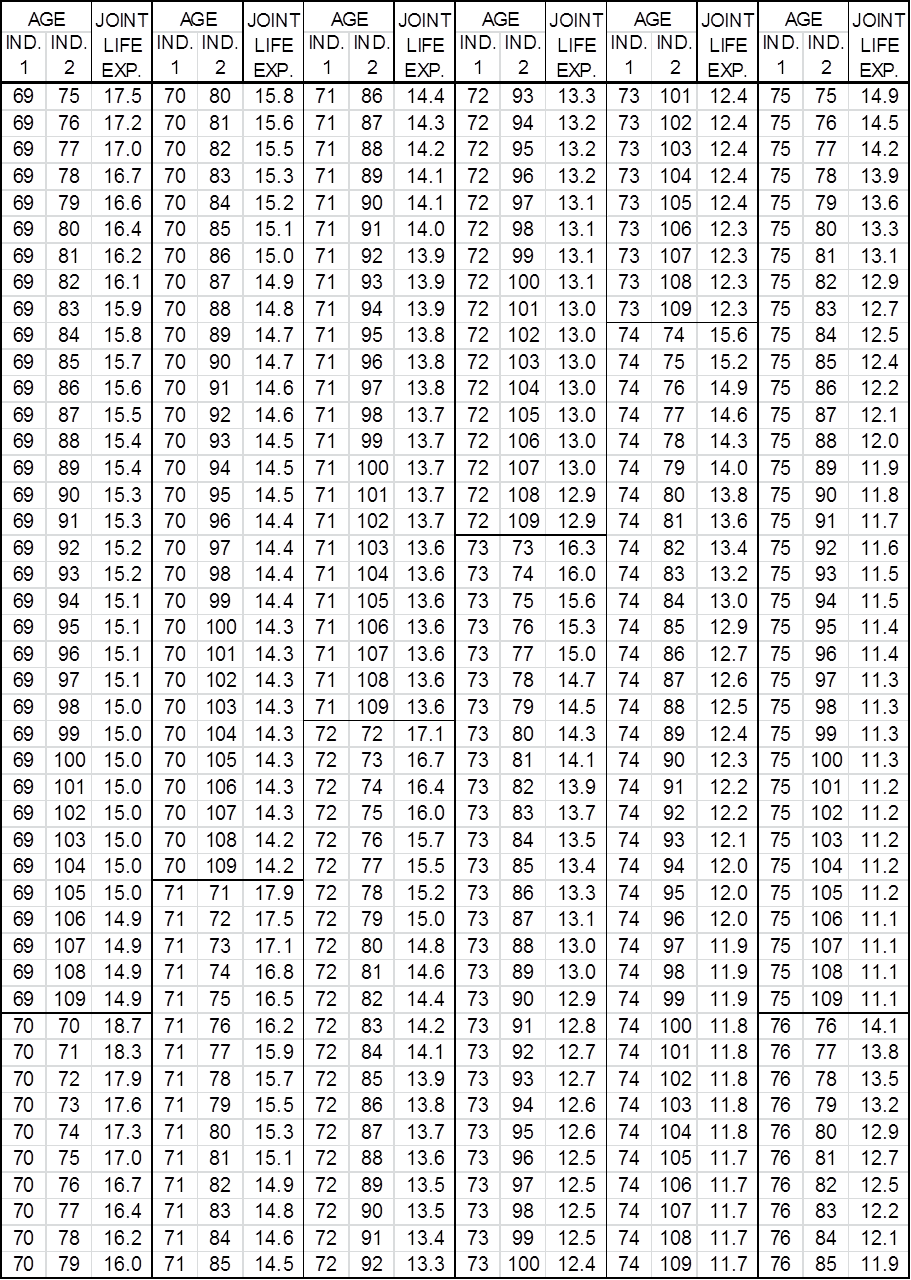

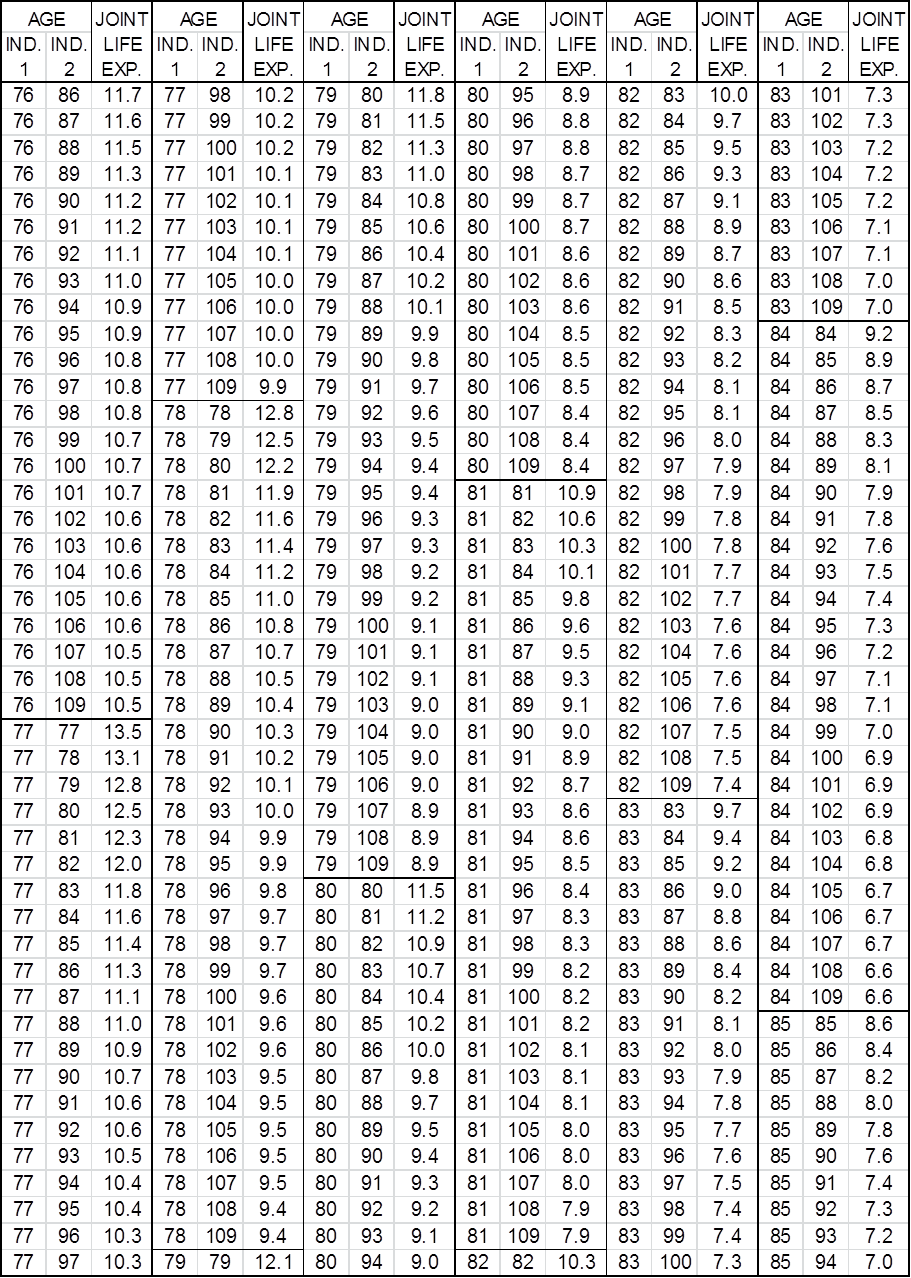

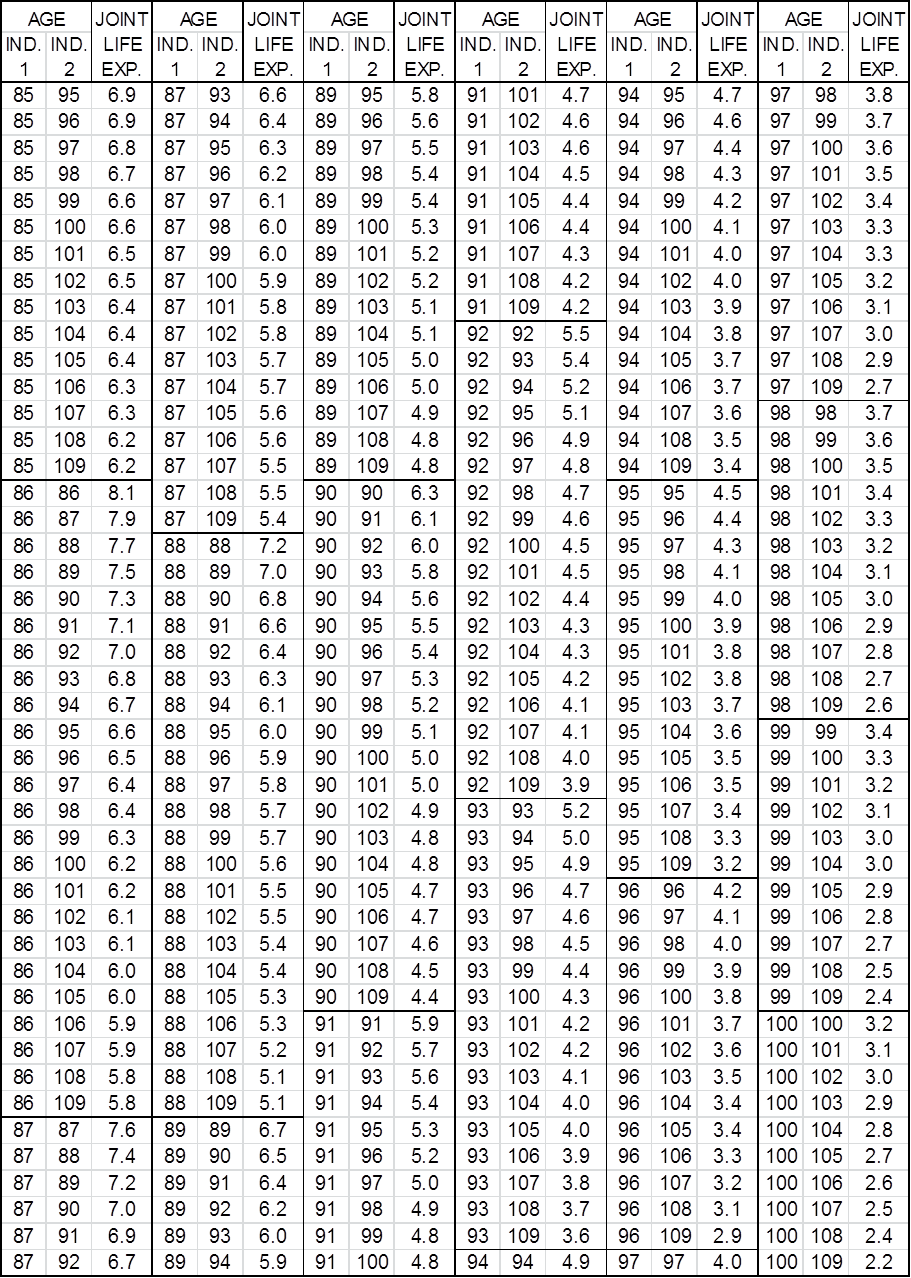

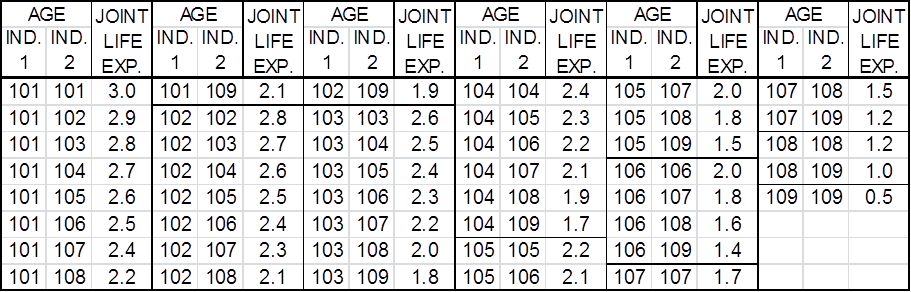

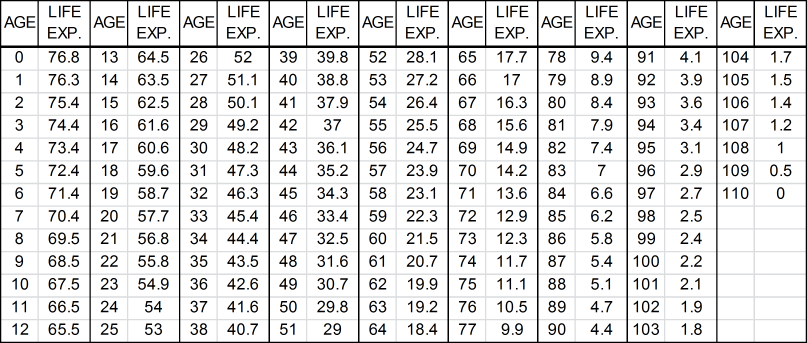

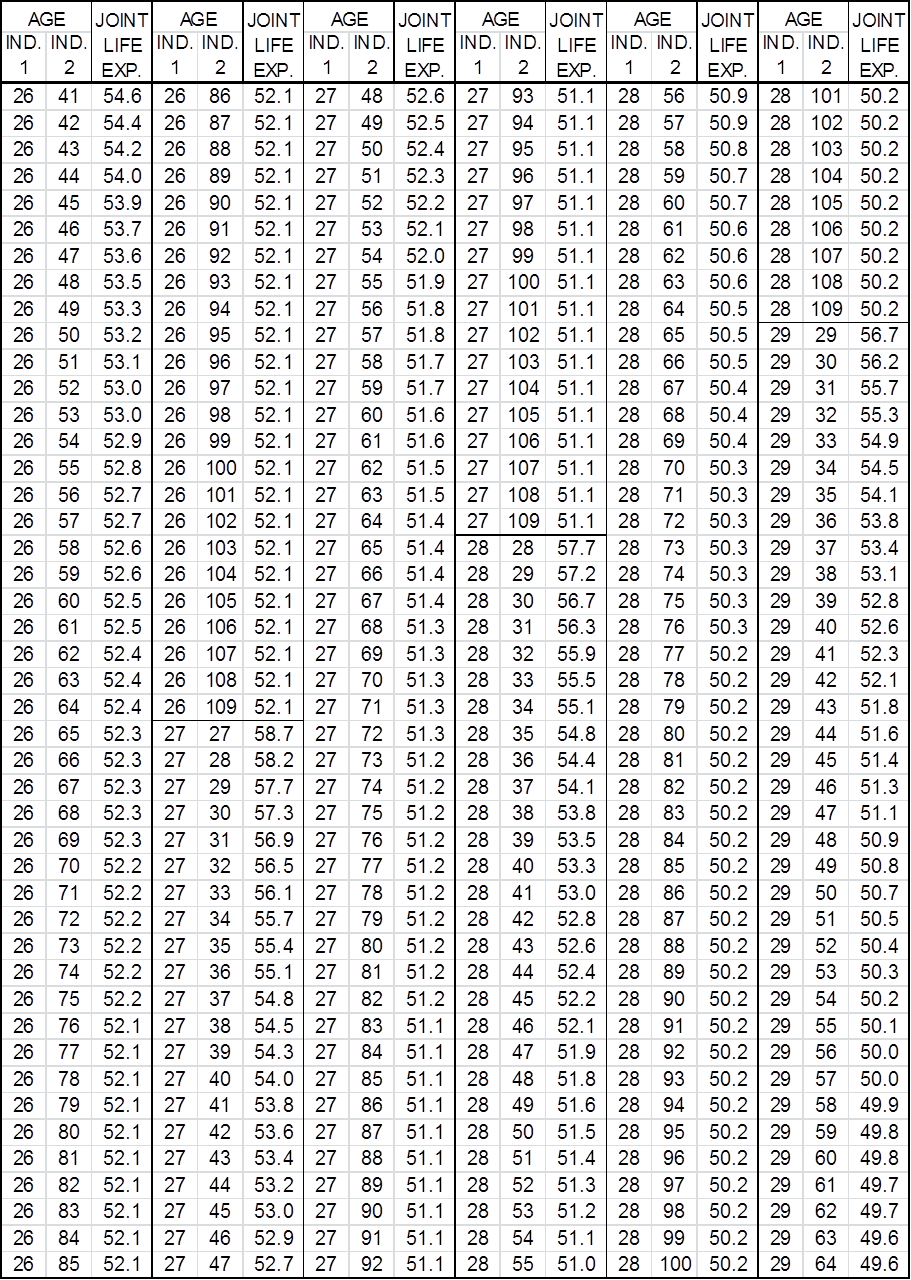

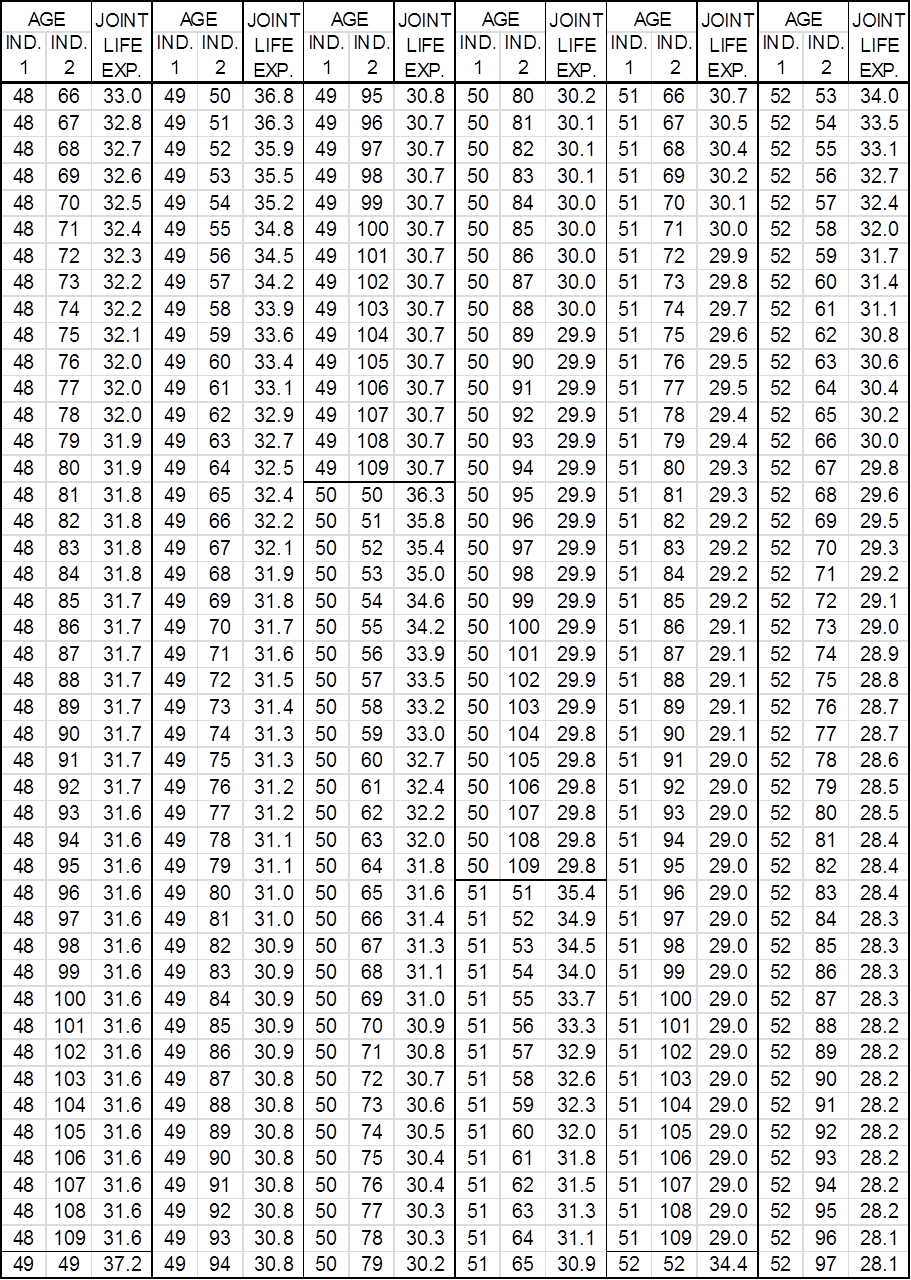

42.4.2708 DETERMINING PRESENT VALUE FOR THE ENDOWMENT CREDIT (1) For purposes of determining the endowment credit, the present value of a contribution is the amount reported to the Internal Revenue Service for that contribution. The present value of a gift contributed to a qualified endowment is based on its fair market value on the date of the gift. (2) As derived from the May 2009 IRS Publication 1457 titled "Actuarial Valuations," the life expectancy tables that shall be used when determining the life expectancy of the annuitant or joint life expectancy of the annuitants, within which the first partial or full-year payment of a deferred charitable gift annuity is required to begin in order for it to be deemed a planned gift for the purposes of 15-30-2327, MCA, are set forth in Tables 1 and 2. (a) Example. The table indicates a 98-year-old annuitant has a life expectancy of 2.5 years. So the first partial year (such as a monthly, quarterly, or semi-annual payment), or full year payment mandated by the annuity contract, must be required to be paid no later than two and one-half years from the date the deferred annuity contract is created. � Table 1: Single Life Expectancies Based on 2000 CM Mortality �

� Table 2: Two Life Expectancies Based on 2000 CM Mortality �

� �

History: 15-30-2327, 15-30-2620, 15-31-501, MCA; IMP, 15-30-2327, 15-30-2328, MCA; NEW, 2000 MAR p. 2109, Eff. 8/11/00; TRANS, from ARM 42.15.519, 2004 MAR p. 1965, Eff. 8/20/04; AMD, 2010 MAR p. 1209, Eff. 5/14/10; AMD, 2014 MAR p. 2039, Eff. 9/5/14. |

| MAR Notices | Effective From | Effective To | History Notes |

|---|---|---|---|

| 42-2-909 | 9/5/2014 | Current | History: 15-30-2327, 15-30-2620, 15-31-501, MCA; IMP, 15-30-2327, 15-30-2328, MCA; NEW, 2000 MAR p. 2109, Eff. 8/11/00; TRANS, from ARM 42.15.519, 2004 MAR p. 1965, Eff. 8/20/04; AMD, 2010 MAR p. 1209, Eff. 5/14/10; AMD, 2014 MAR p. 2039, Eff. 9/5/14. |

| 42-2-822 | 5/14/2010 | 9/5/2014 | History: 15-30-2620, 15-31-501, MCA; IMP, 15-30-2328, MCA; NEW, 2000 MAR p. 2109, Eff. 8/11/00; TRANS, from ARM 42.15.519, 2004 MAR p. 1965, Eff. 8/20/04; AMD, 2010 MAR p. 1209, Eff. 5/14/10. |

| 8/20/2004 | 5/14/2010 | History: Sec. 15-30-305 and 15-31-501, MCA; IMP, Sec. 15-30-166, MCA; NEW, 2000 MAR p. 2109, Eff. 8/11/00; TRANS, from ARM 42.15.519, 2004 MAR p. 1965, Eff. 8/20/04. |

A directory of state agencies is available online at http://www.mt.gov/govt/agencylisting.asp.

For questions about the organization of the ARM or this web site, contact [email protected].

�

�